Earlier this week, we reported on a study by iSeeCars.com regarding changes in the used car market in the last four years. Now, the research firm has released a report with statistics on the slowest quickest-selling new and used cars — and spoiler alert, most of them shouldn’t be a surprise.

Consumer fatigue with the significant price increases of new and used cars is being reflected in their take rates. Overall, new cars are selling an average of 25.7 percent slower than in 2022, though used cars are up 6.1 percent.

“Used car prices were initially driven up by a lack of new car inventory,” said iSeeCars Executive Analyst Karl Brauer. “Now there are plenty of new cars on dealer lots, but consumers aren’t rushing out to buy them. The new car average time-to-sale is down by more than 25 percent even as used cars are selling 6.1 percent faster. This shows buyers are continuing to seek value in the used car market – despite a wide range of new car options.”

New car prices have climbed slightly in the past year, but interest is down after several years of restricted availability. Dealers are still trying to maximize profit on new models, but it’s becoming harder for them to do so. The average days-on-market is 22.7 as of July 2023, an increase of over five days compared to July 2022. The average transaction price is $45,936, a 3.8 percent raise.

The fastest selling new cars are mostly crossovers and SUVs, and a large chunk of them are models that have been recently redesigned and highly anticipated, such as the Range Rover and Kia Carnival. Toyota dominates the top 20 list, with 10 of their offerings making the cut. Every one of General Motors’ large SUVs except the Chevy Suburban is also on the list.

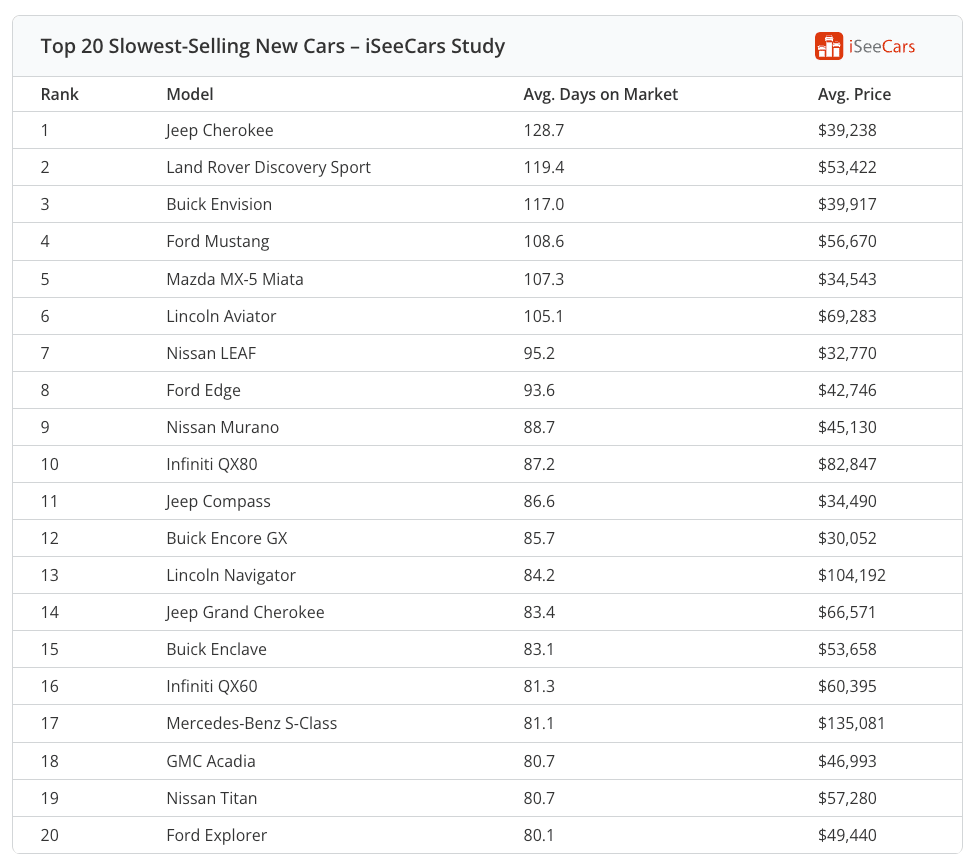

As for the worst performers, the top 20 list consists of vehicles that are well above the industry target of 60 days to sell.

“The lack of new car production during Covid ensured whatever cars did arrive on dealer lots moved quickly,” said Brauer. “But new car production is essentially back to normal, and we’re seeing plenty of cars sitting on dealer lots for an extended period.” Buyers are less desperate for anything they can get their hands on, meaning the list unsurprisingly mainly consists of models that were never very popular to begin with.

Interestingly, a few objectively good cars such as the Mercedes-Benz S-Class, Mazda Miata, and Jeep Grand Cherokee are towards the bottom of the top 20. We suspect the Grand Cherokee, which was recently redesigned, is having its average numbers hindered by the stock of old-generation models still being sold.

Most of the quickest-selling used cars are again crossovers and SUVs, with the majority priced at the heart of the market, between $20,000 and $45,000. Once again, Toyota has several models in the top 20, though the list is dominated by nine Hondas this time.

The average sale time is 49.2 days as of July 2023, compared to 52.4 days last year, representing the aforementioned 6.1 percent change. The average transaction price of a used car is also down 3.6 percent to $33,249.

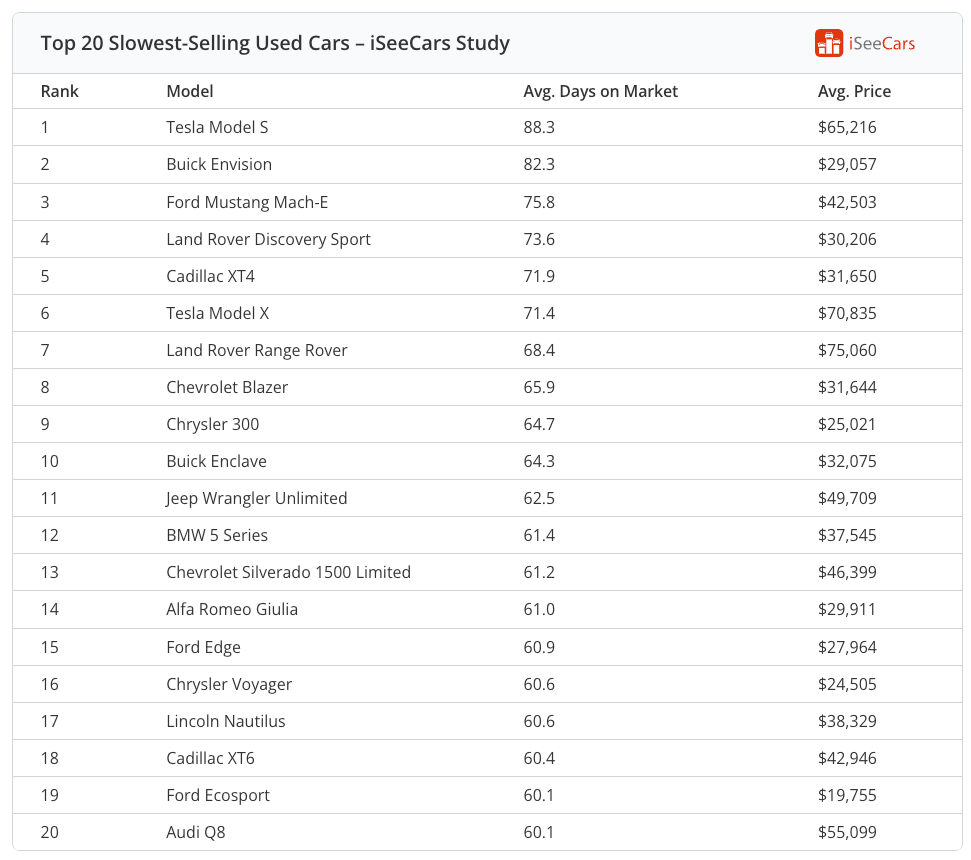

On the flip side, the top 20 lowest performers remain mostly cars that were never favored or models that are simply old and outdated.

“Many of the slowest-selling vehicles, including both Teslas, are older models in need of a redesign,” said Brauer. “But some, like the Ford Mustang Mach-E and Land Rover Range Rover, are new to the market, making it surprising to see them languishing on dealer lots.”

It seems Model Ses are quite the tricky move right now, which may also be due to the fact that prices of new Teslas constantly change. For instance, the base MSRP of a new Model S Plaid just dropped to $89,990 this week, while most pre-owned Plaids are currently on the market for $80,000-85,000.

In conclusion, this is further evidence to suggest the car market is returning to a “normal” state. Demand for new cars is falling as a result of greater availability, and average used car prices are slightly down versus a year ago. We can only hope the trends continue into next year as they are.